Assessed Value/Actual Assessed Value

Property taxes in NYC aren’t calculated based on the actual market value of the property. They are calculated using an assessed value, which is a predetermined fraction of the market value, called the assessment ratios, which are different for different types of properties.

Class-1 Properties, which includes all one- to three-unit residential properties, have an assessment rate of 6%.

Class-2 (and 3, 4) includes all other properties, including larger residential buildings (co-ops, condos, larger townhouses, etc.), commercial and industrial buildings. They have an assessment rate of 45%.

For example, if the market value of a brownstone with two residential units is calculated at $1 million, the assessed value would be just 6% of this amount – $60,000. This is the amount the tax rate for this property type would apply on (20.3% for 2023).

In contrast, a 20-unit condo building may have a market value of about $4 million. Its assessed value would be $1.8 million. That’s the number the tax rate would apply on (12.2% for 2023).

This is called the actual assessed value or simply the assessed value of the property, and for some property classes, there are other stipulations.

Class-1 Properties

For Class-1 properties, the assessed value cannot increase more than 6% in a single year or more than 20% over a five-year period, no matter how much the market value increases. So, even if the market value of the property increases by 10% in a year, the assessed value will only increase by 6% (or less).

But this also allows the city to increase the assessed value of the property even when the market value does not increase. For example, the assessed value of a Class-1 property may increase by 6% even if the market value of the property has actually slipped by 6%.

Class-2 Properties

A similar restriction is applied to some Class-2 properties, categorized as Class-2a, Class-2b, and Class-2c. These are all residential properties with ten or fewer units. Their assessed value growth is restricted to 8% a year or 30% over a five-year period.

Transitional Assessed Value

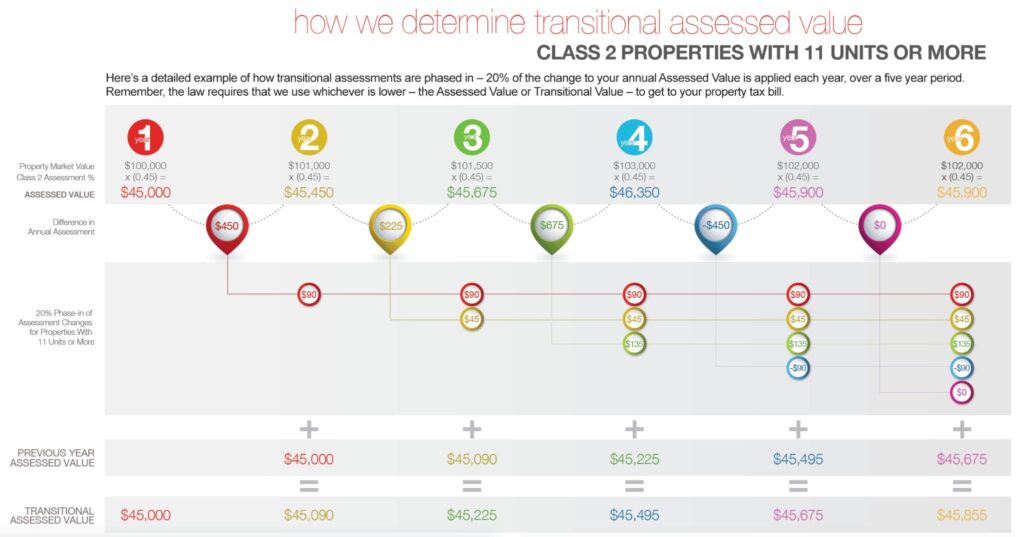

The concept of transitional assessed value applies to Class-2 properties with more than ten units (and Class-4 buildings).

Transitional assessed value is the process of breaking down the change in actual assessed value over a five-year period and adding it to the actual assessed value for the current year. So essentially, only about 20% of the change is applied to the property’s tax basis in the next year. However, since there is a change in market value and, by extension, the actual assessed value of the property every year, multiple “changes” are applied to the taxation cost-basis of the property in any given year.

For example:

- You buy a 15-unit Class-2 property for $5 million in 2023, which is its market value for the year. The assessed value would be $2.25 million.

- If the property appreciates ten percent in market value the next year ($5.5 million in 2024), the assessed value will rise to $2.475 million. That’s a $225,000 difference in the assessed value of the two years.

- Now, this change has to be spread out over five years. So, $225,000 divided by five becomes $45,000.

- This $45,000 will be added to the assessed value of the previous year (2023), which was $2.25 million, to determine the transitional assessed value for the next year (2024).

So, in 2024, there are two cost bases.

The actual assessed value of the property ($2.475 million), which incorporates the full 10% appreciation.

The transitional assessed value, which incorporates the one-fifth/20% slice of this appreciation added to the previous year’s market value = $2,250,000 + $45,000 = $2.295 million.

By law, the city has to choose the lower of the two values to determine your tax obligation. So, in this case, it will go with the transitional assessed value.

It becomes more complicated as these slices keep piling up, though there can’t be more than five in any given year. This is visualized in the following NYC resource and should give you an idea of how transitional assessed value is calculated over the years.